How to Stop Bank Harassment for Loan and Credit Card Recovery

Table of Contents

Introduction

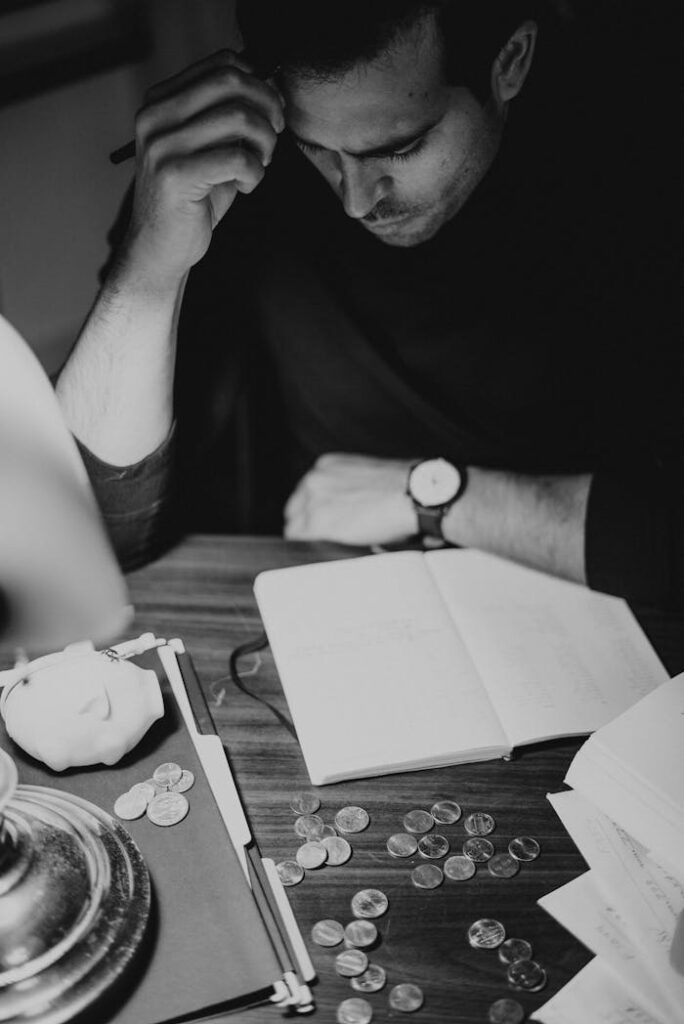

Are you constantly bombarded with multiple calls from your bank, facing harassment for loan and credit card recovery? Dealing with aggressive tactics from financial institutions can be overwhelming and stressful. In this blog post, we will discuss practical strategies to navigate through such challenging situations and protect your rights.

Understanding Harassment from Banks

When banks resort to harassing tactics for debt recovery, it can manifest in various forms such as multiple calls, home and office visits, and interactions with abusive and threatening agents. These tactics can not only disrupt your daily life but also create emotional distress and anxiety. It is essential to understand your rights and options in such circumstances to avoid Bank Harassment for Loan and Credit Card Recovery.

Dealing with Multiple Calls from Bank

Receiving numerous calls from your bank demanding payment can be intimidating. It is important to maintain a record of these calls and communicate with the bank in writing to address your concerns. You can also request them to refrain from contacting you repeatedly and seek a more amicable resolution to the debt to avoid Bank Harassment for Loan and Credit Card Recovery.

Harassment by Home and Office visits

If the bank sends representatives to your home or workplace to demand payment, it can be invasive and distressing. You have the right to refuse entry to such individuals and can choose to communicate with the bank through official channels. Emphasize for Authorization letter & ID card in case 3rd party agent and banker is visiting you. It is crucial to prioritize your safety and well-being in such situations by video recording the entire visit to avoid Bank Harassment for Loan and Credit Card Recovery.

Handling Abusive and Threatening Agents

Encountering aggressive and abusive agents from the bank can be traumatic. Remember that you don’t have to tolerate disrespectful behavior or threats. You can report Bank Harassment for Loan and Credit Card Recovery incidents to the relevant authorities (Nodal Officer) of bank and seek legal guidance to address harassment effectively. You also reserve the right to escalate the case to RBI via their CRM Ombudsman portal. Everyone deserves to be treated with ‘Dignity & Respect’.

Possible steps to resolve

If you are struggling to repay your debts due to financial constraints, consider negotiating with your bank based on your current job and salary situation. Openly communicate your challenges and explore possible options for debt settlement or restructuring. A proactive approach can help you find a viable solution.

Exploring Debt Relief Options in India

In India, there are various debt relief programs & agencies that individuals can benefit from to alleviate financial burden. Conduct thorough research and seek professional assistance to understand these options and determine the best course of action for your debt situation. From debt management plans, debt settlement services to debt consolidation, explore the avenues available to you.

Debt Relief India (DRI) is there for you

Dealing with Bank Harassment for Loan and Credit Card Recovery can be a daunting experience, but it is essential to protect your rights and well-being in such circumstances. By understanding your rights, effectively communicating with the bank, and exploring debt relief options, you can navigate through challenging situations with confidence. Remember, you have the power to address harassment and seek a fair resolution to your debts in India.

Remember, your financial well-being is paramount, and you deserve to be treated with respect and dignity in all interactions with banks and financial institutions. Stay informed, seek support, and take proactive steps towards resolving your debt concerns. Your financial future is in your hands, and you have the strength to overcome challenges and emerge stronger. Stay empowered and informed in your journey towards financial freedom.