In News

ABOUT DEBT RELIEF INDIA

Your Trusted Debt Relief Company in India

With 11+ years of expertise, we specialize in debt harassment relief, loan and credit card settlement, and legal support. Our team of advocates helps you break free from the burden of unmanageable debt, without fear, stress, or any shame.

Our onboarding process takes just 10 minutes. Once you’re with us, we don’t just stop at settling your debts. We also help you plan for a better future through financial planning and budget management, so you can avoid future traps and rebuild your financial foundation with confidence.

Our Services

Comprehensive Debt Relief Services (Loan and Credit Card Settlement)

01.

02.

03.

04.

How To Get Started

7+

Years of Experience

Our 3 Pillar Value

Debt is no longer just a concern, it’s a full-blown crisis in a country like India – and at Debt Relief India, we step in where others step back, offering real solutions, not just promises

Transparency & Clarity

We stand apart from other debt settlement companies in India by offering unmatched transparency and clarity. We ensure every discussion, proposal, and commitment is clear, straightforward, and built on mutual understanding. As one of the trusted debt relief companies in India, we set realistic expectations and walk you through every step, empowering you to make informed decisions about loan or credit card settlements. This honesty builds the foundation of trust our clients appreciate most.

Respecting Time & Delivering Results

Unlike many loan settlement agencies, Debt Relief India deeply values your time. Every proposal we create is time-bound and discussed upfront, ensuring there are no surprises later. As one of the most dependable debt settlement companies in India, we commit to helping you become debt-free within the agreed timeframe. Our disciplined approach ensures that clients not only see progress but also achieve complete financial relief, whether through loan settlement or credit card settlement.

Support Beyond Office Hours

Debt Relief India believes that debt stress doesn’t see the clock or calendar. That’s why we offer dedicated support even during odd hours, weekends, and public holidays. As a people-first debt relief company in India, our team is always ready to assist you whenever you need us. Whether you want help with loan settlements or require urgent support from a credit card settlement agency in India, our professionals are just a call away, ensuring you’re never alone in your journey.

Freedom from Debt. Relief from Harassment..

Why Debt Relief India is Among the Best Debt Settlement Companies in India

1.

Free Counselling, Case Discussion & Budgeting

At Debt Relief India, we believe that the first step toward solving any debt issue is clarity. That’s why we provide absolutely free counselling sessions, case discussions, and budgeting support to every individual, without any hidden fees or obligations. Our team carefully analyses your credit report, evaluates your liabilities, and offers realistic, practical debt settlement solutions suited to your financial situation. We aim to eliminate anxiety, confusion, and fear by empowering you with transparent information and a step-by-step debt relief plan that puts you back in control of your financial life.

2.

Maximum

Waiver on Debt

We are recognized among the leading debt relief companies in India because of our consistent track record of negotiating maximum waivers on unsecured loans, personal loans, and credit card debts. Our experienced negotiators directly engage with lenders, banks, and NBFCs to settle debts at a waiver as high as 94% and the lowest waiver being 58%. We are proud to have helped thousands of clients across India by reducing their financial burden and enabling them to close debts without legal harassment, saving not just money, but their peace of mind and dignity.

3.

Lowest Fee Structure in the Market

Transparency and affordability are the core our service at Debt Relief India. Unlike others that charge high fees, often hidden or unclear, we maintain the lowest fee structure in the market, strictly capped at just 5% of the total outstanding debt. This ensures that clients don’t sink deeper into debt while trying to escape it. As a trustworthy debt relief company in India, we prioritize ethical practices, where our clients clearly know what they are paying for. Whether it’s unsecured loans or credit card dues, our fee remains transparent, fair, and performance-based, reflecting our integrity as a loan and credit card settlement agency in India that truly puts people before profits.

4.

Flexible Payment Terms

We understand that every debt story is unique, and so are the repayment capabilities of individuals. At Debt Relief India, we offer flexible payment terms that allow our clients to become debt-free within as little as 6 months to a maximum of 7 years, depending entirely on their financial strength and savings capacity. We do not impose rigid plans. Instead, we tailor personalized debt settlement strategies and timelines that balance affordability with timely resolution, ensuring that our clients move toward a debt-free life without sacrificing their daily needs or mental peace.

5.

Zero Fee Plans

Those who serve our nation or face extreme life hardships should not be burdened further with financial worries. That’s why we offer Zero Fee Plans for farmers, defence personnel, families affected by medical emergencies, suicide cases, and those suffering from permanent disability. Many debt settlement companies in India impose high fees regardless of the situation, but we bring empathy into our process. As a responsible loan settlement agency, we ensure that these vulnerable groups get free and professional support, helping them settle debts without added financial pressure. This approach makes us a preferred name among debt relief companies in India, showing our commitment to social responsibility and humanity.

6.

Pan-India Legal Support

Debt challenges can turn into legal battles, which often terrify individuals who lack access to the right resources. Debt Relief India sets itself apart from typical debt agency companies in India by offering Pan-India legal support. With a strong network of expert advocates across all 29 states, we ensure that no client is left alone, no matter where they reside. Whether you’re facing court cases, notices, or threats, our legal experts intervene immediately to protect your rights. As a customer-focused loan settlement agency and credit card settlement agency in India, we bring localized, reliable, and timely legal support, making sure justice is within everyone’s reach.

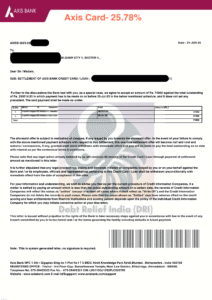

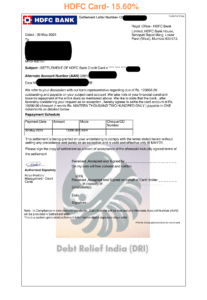

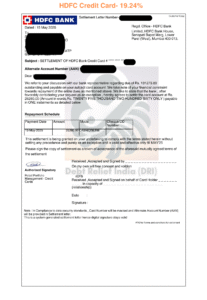

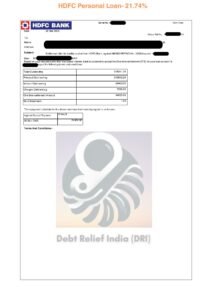

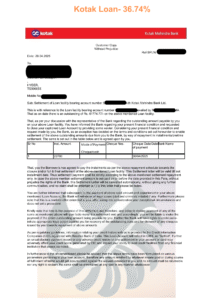

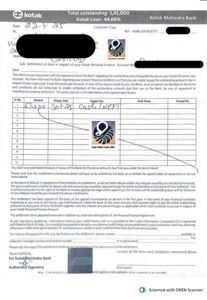

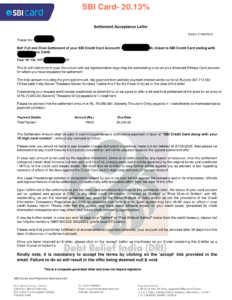

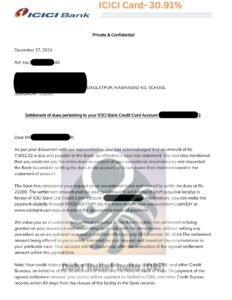

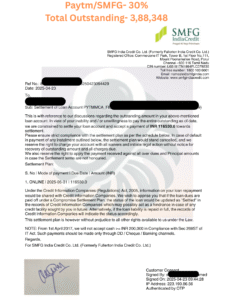

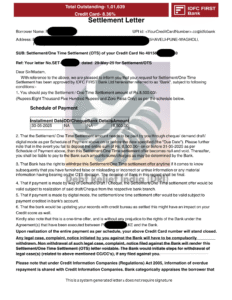

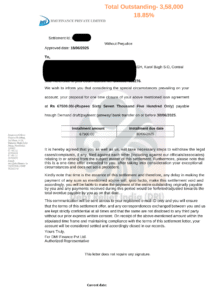

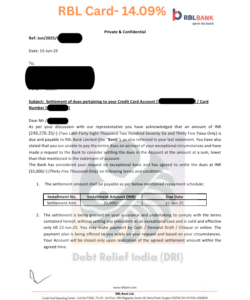

Our Work with Banks & NBFCs

Settlement Letters

Your Rights as a Debtor

Know your legal rights before facing any recovery agent or lender threats, because staying informed is your strongest shield against harassment, misinformation, and unfair treatment.

1. Right to Receive Adequate Notice

As a borrower, you are legally entitled to receive a 60-day notice from lenders or financial institutions before they initiate any legal proceedings or recovery actions against you. This notice period gives you a fair opportunity to arrange funds, settle your dues, or raise objections, if any. Ignoring such notices can result in serious consequences, so it’s crucial to stay alert, review the notice carefully, and act within the specified time frame to protect your rights.

2. Right to Be Heard

You have the fundamental right to present your side of the story. If you feel that the lender’s actions are unfair or unlawful, you can file an objection or complaint with the concerned authority or ombudsman. The lender is legally bound to consider your grievance and provide a proper and fair response. This ensures that you are not left helpless and that due process is followed before any extreme recovery steps are taken.

3. Right to Fair Treatment

Under RBI guidelines, recovery agents are strictly prohibited from using abusive language, threats, or physical intimidation during the debt recovery process. They can only contact you between 7 a.m. and 7 p.m., respecting your personal and professional space. Any harassment, public humiliation, or unethical behavior is a violation of your rights, and you can lodge a formal complaint with the police, lender, or regulatory bodies against such conduct.

4. Right to Privacy

Your personal and financial information, including the details of your outstanding debts, is protected under privacy laws. Recovery agents or lenders are not allowed to publicly disclose your debts or inform neighbors, colleagues, or relatives about your liabilities. If such privacy is violated, you can take legal action for defamation, harassment, or breach of confidentiality, ensuring your dignity remains intact throughout the debt resolution process.

5. Right to Fair Valuation of Assets

In case your assets are seized by the lender for loan recovery, you have the right to demand a fair, transparent, and market-based valuation of those assets. If the recovered amount exceeds your dues, the lender is legally required to refund the excess balance to you. This ensures you are not exploited during the repossession process and that the entire transaction is conducted ethically and lawfully.

Client Testimonials

Hear What Our Clients Have to Say

Happy Clients

Debt GONE, Happiness ON..!

Our Blogs

Understanding RBI Guidelines on Loan Settlement & Harassment in India

Financial struggles are tough but that doesn’t mean you have to tolerate harassment or give…

How to Deal with Loan Recovery Agents in India (2025) – Know Your Rights

1. Why this matters in 2025 RBI circulars in 2024 and early 2025 tightened conduct…

5 Loan-Settlement Myths Banks Still Won’t Admit in 2025

5 Loan-Settlement Myths Banks Still Won’t Admit in 2025 Loan settlement (also called one-time settlement…

What is Debt Settlement in India – Process, Legality & Benefits

Debt has become a daily stressor for millions of Indians. With rising EMIs, job instability,…

Bad Debt and Financial Literacy in 2025: Navigating a Changing Financial Landscape

The financial world is rapidly evolving, and in 2025, digital platforms, instant loans, and ever-increasing…

Credit Cards and Personal Loans: Unlocking an Aspirational Lifestyle for Millennials in 2025

Millennials have reshaped the financial landscape significantly, particularly through their approach to spending, investing, and…