Check My Savings - With Debt Relief Meter

Your First Step to a Debt-Free Life

START WITH OUR DEBT RELIEF METER

Enter your debt details below and check your savings.

₹0

₹0*

You can save upto 70%* on your debt.

(1 - 5 Years)

₹207000(6-12 Months)

₹267000*Repayment without support assumes 5% monthly on credit cards and 13% to 28% on personal loan dues. Our estimate is based on a 40% average negotiated settlement. Actual savings may vary.

Understand how much of your debt can be waived

Get a clear idea of your monthly plan

Know how long it will take to close everything

ideal for anyone dealing with

Credit Cards

Personal Loans

Business Loans

Credit Cards

Personal Loans

Business Loans

Introducing the Debt Relief Meter

Our Debt Relief Meter is a smart calculator designed to give you an instant breakdown of your financial recovery plan.

You Tell Us Your Total Debt

Understand how much of your debt can be waived

We Estimate Realistic Waivers

Based on similar case results, we show how much could be reduced.

You Get a Custom Snapshot

We estimate your final payment amount, monthly saving goal, and timeframe to become debt-free.

We Simplify the Process

No jargon, no hidden terms just clean numbers and next steps.

Our Track Record Speaks for Itself

We’re proud of the lives we’ve helped turn around

Clients

Settled

Folios

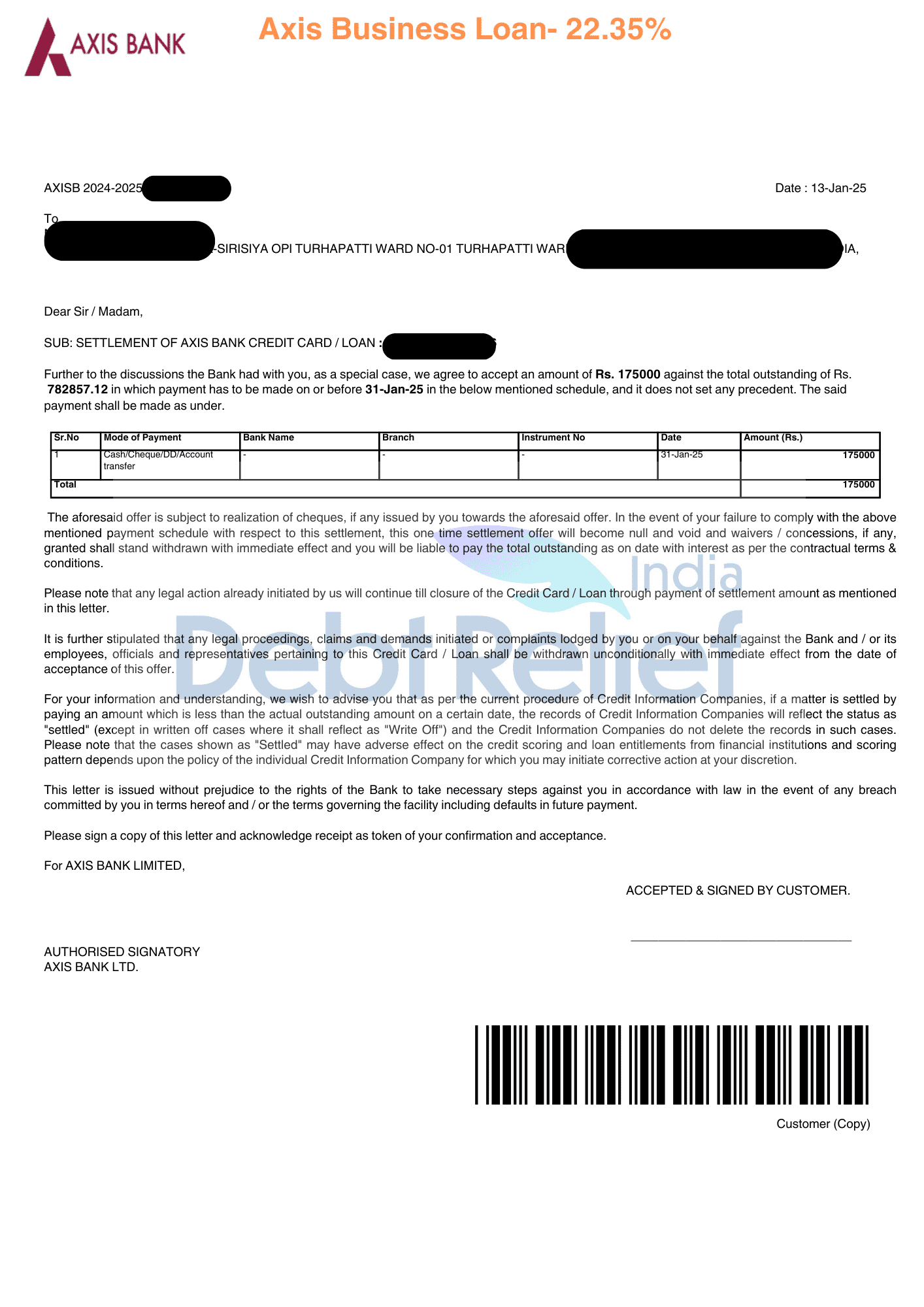

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

India’s first Meta Verified Settlement Company

Our 3 Pillar Value

Debt is no longer just a concern, it’s a full-blown crisis in a country like India and at Debt Relief India, we step in where others step back, offering real solutions, not just promises

Transparency & Clarity

We stand apart from other debt settlement companies in India by offering unmatched transparency and clarity. We ensure every discussion, proposal, and commitment is clear, straightforward, and built on mutual understanding. As one of the trusted debt relief companies in India, we set realistic expectations and walk you through every step, empowering you to make informed decisions about loan or credit card settlements. This honesty builds the foundation of trust our clients appreciate most.

Respecting & Delivering Results

Unlike many loan settlement agencies, Debt Relief India deeply values your time. Every proposal we create is time-bound and discussed upfront, ensuring there are no surprises later. As one of the most dependable debt settlement companies in India, we commit to helping you become debt-free within the agreed timeframe. Our disciplined approach ensures that clients not only see progress but also achieve complete financial relief, whether through loan settlement or credit card settlement.

Support Beyond Office Hours

Debt Relief India believes that debt stress doesn’t see the clock or calendar. That’s why we offer dedicated support even during odd hours, weekends, and public holidays. As a people-first debt relief company in India, our team is always ready to assist you whenever you need us. Whether you want help with loan settlements or require urgent support from a credit card settlement agency in India, our professionals are just a call away, ensuring you’re never alone in your journey.

Transparency & Clarity

We stand apart from other debt settlement companies in India by offering unmatched transparency and clarity. We ensure every discussion, proposal, and commitment is clear, straightforward, and built on mutual understanding. As one of the trusted debt relief companies in India, we set realistic expectations and walk you through every step, empowering you to make informed decisions about loan or credit card settlements. This honesty builds the foundation of trust our clients appreciate most.

Respecting Time & Delivering Results

Unlike many loan settlement agencies, Debt Relief India deeply values your time. Every proposal we create is time-bound and discussed upfront, ensuring there are no surprises later. As one of the most dependable debt settlement companies in India, we commit to helping you become debt-free within the agreed timeframe. Our disciplined approach ensures that clients not only see progress but also achieve complete financial relief, whether through loan settlement or credit card settlement.

Support Beyond Office Hours

Debt Relief India believes that debt stress doesn’t see the clock or calendar. That’s why we offer dedicated support even during odd hours, weekends, and public holidays. As a people-first debt relief company in India, our team is always ready to assist you whenever you need us. Whether you want help with loan settlements or require urgent support from a credit card settlement agency in India, our professionals are just a call away, ensuring you’re never alone in your journey.

Banks & NBFCs We Have Dealt With

We’ve successfully negotiated settlements with leading banks, NBFCs, and financial institutions across India.

Your Rights as a Debtor

Know your legal rights before facing any recovery agent or lender threats, because staying informed is your strongest shield against harassment, misinformation, and unfair treatment.

RIGHT TO Receive Adequate Notice

As a borrower, you are legally entitled to receive a 60-day notice from lenders or financial institutions before they initiate any legal proceedings or recovery actions against you. This notice period gives you a fair opportunity to arrange funds, settle your dues, or raise objections, if any. Ignoring such notices can result in serious consequences, so it’s crucial to stay alert, review the notice carefully, and act within the specified time frame to protect your rights.

RIGHT TO Be Heard

You have the fundamental right to present your side of the story. If you feel that the lender’s actions are unfair or unlawful, you can file an objection or complaint with the concerned authority or ombudsman. The lender is legally bound to consider your grievance and provide a proper and fair response. This ensures that you are not left helpless and that due process is followed before any extreme recovery steps are taken.

RIGHT TO Privacy

Your personal and financial information, including the details of your outstanding debts, is protected under privacy laws. Recovery agents or lenders are not allowed to publicly disclose your debts or inform neighbors, colleagues, or relatives about your liabilities. If such privacy is violated, you can take legal action for defamation, harassment, or breach of confidentiality, ensuring your dignity remains intact throughout the debt resolution process.

RIGHT TO Fair Treatment

Under RBI guidelines, recovery agents are strictly prohibited from using abusive language, threats, or physical intimidation during the debt recovery process. They can only contact you between 7 a.m. and 7 p.m., respecting your personal and professional space. Any harassment, public humiliation, or unethical behavior is a violation of your rights, and you can lodge a formal complaint with the police, lender, or regulatory bodies against such conduct.

RIGHT TO Fair Valuation of Assets

In case your assets are seized by the lender for loan recovery, you have the right to demand a fair, transparent, and market-based valuation of those assets. If the recovered amount exceeds your dues, the lender is legally required to refund the excess balance to you. This ensures you are not exploited during the repossession process and that the entire transaction is conducted ethically and lawfully.

Customer testimonials

Hear What Our Clients Have to Say

25+ Reviews

24+ Reviews

-

Exceptional experience with Debt Relief India.I have been using the services of Debt Relief India for 4 month now and I can say from my experience that the efforts that have been put by Mr. Kanishk Dutt have been commendable. I had reached a point where I felt completely helpless and hopeless due to the credit burden. Mr. Kanishk Dutt is doing an excellent job when it comes to managing the calls from the recovery agents and from the banks. He is extremely approachable and always available whenever needed. He is always available whenever needed and responds within 2-3 minutes. He works with proper ethics and integrity.

Mishty Raj

-

Debt Relief India is Awesomely Awesome Team Debt Relief India is doing an excellent job when it comes to managing the calls from the recovery agents and from the banks. The founder Mr Kanishk Dutt is extremely approachable and always available whenever needed, The entire DRI team is doing a fantastic job, They are always available and you get responses within 2-3 minutes, The team works with proper ethics and integrity. A big shoutout to Mr Kanishk who has helped me in each and every way to manage the the recovery calls and also guiding to a path of freedom from debt. I will surely recommend availing there services as Team DRI are definitely saviours. Excellent Work Team DRI and especially Mr Dutt. Keep up the good work 😊

Jude Castleton

-

I was really worried due to my debt and recovery calls. But thanks to the DRI team and kanishk sir who came to my rescue. And supported me in my tough times. Managing my all calls. They also helped me to stop my home visits. They will guide you well and legal. kudos to kanishk sir and team DRI.

Shivam Raval

-

It is a good experience with Debt Relief India and the team in my 1st month. Mr. Kanishk Dutt is always there for any of my queries and a very good advisor. I am very much sure that we will settle the loan as quick as possible. Thanks DRI, you are doing a great job.

Kanchan Mala

-

Exceptional and mind-blowing work...Thank you from the bottom of my heart I have been using the services of Debt Relief India for 1 month now and I can say from my experience that the efforts that have been put by the team and Mr. Kanishk Dutt have been commendable. I have felt so relieved in this tenure otherwise prior to coming in contact with DRI, I was helpless and was not finding ways to tackle the banks and NBFCs but not only my harassment has been handled by the team but their constant guidance and support have given me a lot of confidence to get out of this situation which I am hoping in coming months I would come out. Thank you for all the help and support and I would look forward further to get your constant guidance.

Atul Kumar

-

I was very much tensed and frustrated… I was very much tensed and frustrated with recovery calls but when I contacted Mr Kanishk, he helped me a lot. Keep it up. You are doing an awesome work. God bless you.

Kharak Singh Khalsa

-

Debt Relief India is a completely satisfactory and trustworthy organization when it comes to debt resolution. There was a time in my life when everything was peaceful — no loans, no credit issues. But then a medical emergency in my family forced me to take credit. From just one query, multiple companies started calling and selling their loan products. I always maintained a clean repayment track and paid all EMIs on time. But life took a tough turn when I lost my job and had no income. To maintain my repayment, I ended up taking more credit, and slowly, I fell into a debt trap. I contacted all the lenders and requested for some time, but no one helped. Instead, they kept adding charges and started harassing me through calls and messages. It reached a point where I felt completely helpless and hopeless. I even had thoughts that it was the end of my life. That's when I luckily found Debt Relief India and got in touch with Mr. Kanishk. From the very first interaction, he gave me moral support, explained the process clearly, and showed me that there was a way out. What makes DRI different is that they don’t burden you with high fees like other companies — they only take a small advance towards settlements and guide you step-by-step with honesty and care. Thanks to Debt Relief India, I now have mental peace and a clear path towards financial freedom. I genuinely thank Mr. Kanishk and the entire team for their dedication. If you’re someone going through a tough financial phase due to unavoidable circumstances, don’t lose hope. Contact DRI. They are genuine, transparent, and truly helpful. I strongly recommend them to anyone facing credit or debt-related challenges.

PRASSHANTH MYSA

-

It was in the month of November when I felt that I would not be able to pay my dues... Just like that, while scrolling on Instagram, I saw an advertisement of Debt Relief India and wanted to contact them... Now I feel that this decision was my best decision... I was so distressed by the harassment calls that I had to use medicine for high blood pressure... Along with the harassment calls, the agents' home visits and office visits were also stopped by Debt Relief India... I am very happy that I got relief from all these calls and visits...From that day till today, every problem of my dues has been solved very well, to the extent that when I message, I also get a fast reply... And soon I will really get relief from debt... Thanks Debt Relief India and special thanks to Kanishk Sir for this support

Piyush Kumar

-

I had a great experience with the debit specialist, *"Debt Relief* of the Person," who took the time to genuinely care about our worries and answer all of our inquiries, *Mr.Kanishk* . ** Clearly described the services offered by the business and presented the options in an understandable manner. The entire process was easy and comforting because of their professionalism and kind demeanor. We appreciate *Mr. Kanishk/Debt Relief* excellent service and assistance in starting our path to financial independence.

Madan Chawla

-

Its a tough process and Debt relief India is making sure that they are with me in this process. The smallest query is also handled very well and they have been guiding me on each step. I would definitely recommend it to someone who is in the situation of debt trap.

Pooja

-

Helped me in my loan clearence and cc clearence and very polite and helpful towards the clearence of debt as such also fast resolution is achieved with the top notch service.

Luv Dhir

-

Excellent Service... Their professionalism is the key assets. The kind of support and hand holding DRI provide is unmatched... DRI is the best... Please keep this good work continued...

Gopinath Banerjee

-

DRI is best and awesome services

Mohnish Kumar

-

Very cooperative Handle every thing professionally. Making me debt free 👍

Subeet Anand

-

I join from March 2024 to till date response is explained

Santosh Kumar

-

They have good team to manage your calls and also they have Experienced Debt consultant which helps you to get rid out of all your debt .

Akshay Verma

-

THE BEST & PROFESSIONAL services across India!

Menka

-

This company is really doing good, They respond to very call and help us to be stress free. Thanks DRI. Am still having contact with them

Beena k nair

-

It's really a big relief after joining debt relief, very much hopeful with the help of their team will soon overcome with all the debts. Thank you so much for kind support & timely cooperation.

Sayada

-

It was Awesome experience , Very supportive team.

Manas

-

Great service provider. My stress of debt has been reduce due to DRI

Sandeep Kumar

-

Kanishk sir is corporate sir mujay kisi bhi tarah ki peryshani nahi anay deytay sir is best

Aman Sharma

-

Since the day I have taken the services from DRI I have been advised in each and every situation proactively with prompt responses. The team of DRI are very well versed with the banking law and they're handling all my loans and credit cards related calls very diligently. This is all we want from a client perspective that in this world where people are committing suicides due to loan pressures there is DRI who will take care of all the things and will make your life easy. Thanks DRI & Team for all the efforts and hardwork

Anzal Mansuri

-

Very good service

Amit Agarwal

-

The they handled creditors is good.

Sandip Kumar Nath

-

Exceptional experience with Debt Relief India.I have been using the services of Debt Relief India for 4 month now and I can say from my experience that the efforts that have been put by Mr. Kanishk Dutt have been commendable. I had reached a point where I felt completely helpless and hopeless due to the credit burden. Mr. Kanishk Dutt is doing an excellent job when it comes to managing the calls from the recovery agents and from the banks. He is extremely approachable and always available whenever needed. He is always available whenever needed and responds within 2-3 minutes. He works with proper ethics and integrity.

Mishty Raj

-

Debt Relief India is Awesomely Awesome Team Debt Relief India is doing an excellent job when it comes to managing the calls from the recovery agents and from the banks. The founder Mr Kanishk Dutt is extremely approachable and always available whenever needed, The entire DRI team is doing a fantastic job, They are always available and you get responses within 2-3 minutes, The team works with proper ethics and integrity. A big shoutout to Mr Kanishk who has helped me in each and every way to manage the the recovery calls and also guiding to a path of freedom from debt. I will surely recommend availing there services as Team DRI are definitely saviours. Excellent Work Team DRI and especially Mr Dutt. Keep up the good work 😊

Jude Castleton

-

I was really worried due to my debt and recovery calls. But thanks to the DRI team and kanishk sir who came to my rescue. And supported me in my tough times. Managing my all calls. They also helped me to stop my home visits. They will guide you well and legal. kudos to kanishk sir and team DRI.

Shivam Raval

-

It is a good experience with Debt Relief India and the team in my 1st month. Mr. Kanishk Dutt is always there for any of my queries and a very good advisor. I am very much sure that we will settle the loan as quick as possible. Thanks DRI, you are doing a great job.

Kanchan Mala

-

Exceptional and mind-blowing work...Thank you from the bottom of my heart I have been using the services of Debt Relief India for 1 month now and I can say from my experience that the efforts that have been put by the team and Mr. Kanishk Dutt have been commendable. I have felt so relieved in this tenure otherwise prior to coming in contact with DRI, I was helpless and was not finding ways to tackle the banks and NBFCs but not only my harassment has been handled by the team but their constant guidance and support have given me a lot of confidence to get out of this situation which I am hoping in coming months I would come out. Thank you for all the help and support and I would look forward further to get your constant guidance.

Atul Kumar

-

I was very much tensed and frustrated… I was very much tensed and frustrated with recovery calls but when I contacted Mr Kanishk, he helped me a lot. Keep it up. You are doing an awesome work. God bless you.

Kharak Singh Khalsa

-

Debt Relief India is a completely satisfactory and trustworthy organization when it comes to debt resolution. There was a time in my life when everything was peaceful — no loans, no credit issues. But then a medical emergency in my family forced me to take credit. From just one query, multiple companies started calling and selling their loan products. I always maintained a clean repayment track and paid all EMIs on time. But life took a tough turn when I lost my job and had no income. To maintain my repayment, I ended up taking more credit, and slowly, I fell into a debt trap. I contacted all the lenders and requested for some time, but no one helped. Instead, they kept adding charges and started harassing me through calls and messages. It reached a point where I felt completely helpless and hopeless. I even had thoughts that it was the end of my life. That's when I luckily found Debt Relief India and got in touch with Mr. Kanishk. From the very first interaction, he gave me moral support, explained the process clearly, and showed me that there was a way out. What makes DRI different is that they don’t burden you with high fees like other companies — they only take a small advance towards settlements and guide you step-by-step with honesty and care. Thanks to Debt Relief India, I now have mental peace and a clear path towards financial freedom. I genuinely thank Mr. Kanishk and the entire team for their dedication. If you’re someone going through a tough financial phase due to unavoidable circumstances, don’t lose hope. Contact DRI. They are genuine, transparent, and truly helpful. I strongly recommend them to anyone facing credit or debt-related challenges.

PRASSHANTH MYSA

-

It was in the month of November when I felt that I would not be able to pay my dues... Just like that, while scrolling on Instagram, I saw an advertisement of Debt Relief India and wanted to contact them... Now I feel that this decision was my best decision... I was so distressed by the harassment calls that I had to use medicine for high blood pressure... Along with the harassment calls, the agents' home visits and office visits were also stopped by Debt Relief India... I am very happy that I got relief from all these calls and visits...From that day till today, every problem of my dues has been solved very well, to the extent that when I message, I also get a fast reply... And soon I will really get relief from debt... Thanks Debt Relief India and special thanks to Kanishk Sir for this support

Piyush Kumar

-

I had a great experience with the debit specialist, *"Debt Relief* of the Person," who took the time to genuinely care about our worries and answer all of our inquiries, *Mr.Kanishk* . ** Clearly described the services offered by the business and presented the options in an understandable manner. The entire process was easy and comforting because of their professionalism and kind demeanor. We appreciate *Mr. Kanishk/Debt Relief* excellent service and assistance in starting our path to financial independence.

Madan Chawla

-

Its a tough process and Debt relief India is making sure that they are with me in this process. The smallest query is also handled very well and they have been guiding me on each step. I would definitely recommend it to someone who is in the situation of debt trap.

Pooja

-

Helped me in my loan clearence and cc clearence and very polite and helpful towards the clearence of debt as such also fast resolution is achieved with the top notch service.

Luv Dhir

-

Excellent Service... Their professionalism is the key assets. The kind of support and hand holding DRI provide is unmatched... DRI is the best... Please keep this good work continued...

Gopinath Banerjee

-

DRI is best and awesome services

Mohnish Kumar

-

Very cooperative Handle every thing professionally. Making me debt free 👍

Subeet Anand

-

I join from March 2024 to till date response is explained

Santosh Kumar

-

They have good team to manage your calls and also they have Experienced Debt consultant which helps you to get rid out of all your debt .

Akshay Verma

-

THE BEST & PROFESSIONAL services across India!

Menka

-

This company is really doing good, They respond to very call and help us to be stress free. Thanks DRI. Am still having contact with them

Beena k nair

-

It's really a big relief after joining debt relief, very much hopeful with the help of their team will soon overcome with all the debts. Thank you so much for kind support & timely cooperation.

Sayada

-

It was Awesome experience , Very supportive team.

Manas

-

Great service provider. My stress of debt has been reduce due to DRI

Sandeep Kumar

-

Kanishk sir is corporate sir mujay kisi bhi tarah ki peryshani nahi anay deytay sir is best

Aman Sharma

-

Since the day I have taken the services from DRI I have been advised in each and every situation proactively with prompt responses. The team of DRI are very well versed with the banking law and they're handling all my loans and credit cards related calls very diligently. This is all we want from a client perspective that in this world where people are committing suicides due to loan pressures there is DRI who will take care of all the things and will make your life easy. Thanks DRI & Team for all the efforts and hardwork

Anzal Mansuri

-

Very good service

Amit Agarwal

-

The they handled creditors is good.

Sandip Kumar Nath

-

I have been using the services of Debt Relief India for 1 month now and I can say from my experience that the efforts that have been put by the team and Mr. Kanishk Dutt have been commendable. I have felt so relieved in this tenure otherwise prior to coming in contact with DRI, I was helpless and was not finding ways to tackle the banks and NBFCs but not only my harassment has been handled by the team but their constant guidance and support have given me a lot of confidence to get out of this situation which I am hoping in coming months I would come out. Thank you for all the help and support and I would look forward further to get your constant guidance.

Kumar Atul

-

It is a good experience with Debt Relief India and the team. Mr. Kanishk Dutt is always there for any of my queries and a very good advisor. I am very much sure that we will settle the loan as quick as possible. Thanks DRI, you are doing a great job.

Kanchan Mala

-

I was really worried due to my debt . And recovery calls and their harrasment. But thanks to the TEAM DRI. who came to my rescue. They managed my all calls from recovery agency and banks. And gave me releif and bought me time so i can focus on my work and manage my things. They also helped me to stop all my home visits by guiding me legally. Kudos to the team DRI and kanishk sir. I will recommend their services. They don't charge any settlement fees which do make them unique settlement agency And the lowest monthly fees. THANKS TO TEAM DRI.

Shivam Raval

-

It was in the month of November when I felt that I would not be able to pay my dues... Just like that, while scrolling on Instagram, I saw an advertisement of Debt Relief India and wanted to contact them... Now I feel that this decision was my best decision... I was so distressed by the harassment calls that I had to use medicine for high blood pressure... Along with the harassment calls, the agents' home visits and office visits were also stopped by Debt Relief India... I am very happy that I got relief from all these calls and visits...From that day till today, every problem of my dues has been solved very well, to the extent that when I message, I also get a fast reply... And soon I will really get relief from debt... Thanks Debt Relief India and special thanks to Kanishk Sir for this support

Piyush Kumar

-

DRI has been very helpful in my loan and CC clearence and fast resolution was given to me very satisfied with their services.

Luv Dhir

-

My personal experience so far has been very good and satisfactory. They have been handling the harrasment calls effectively. More importantly they take care of the home visits by collection agents very well who otherwise would create an embarassing situation. There were times when they have helped me out from visits and calls beyond working hours.

Mohammed Sibgath

-

Debt Relief help me for resolving all my Loan problems “I was drowning in business loans debt and didn’t know where to turn. I found out about the Debt Relief India program which made the process of regaining control over my finances so much easier than I expected. The team is extremely professional and patient with me. They explained every step and gave me the support I needed. Within a few months, I saw a significant reduction in my debt. The relief of not being harassed by creditors is priceless! I highly recommend Debt Relief India their services to anyone struggling with debt.”

Dipesh Patil

-

Professional and nice behaviour of Mr. Kanishk Ji. Keep up the good work 👍

Kharak Singh Khalsa

-

Great service, Enrolling DRI (DEBT RELIEF INDIA) is the best decision of mine.

Yagyansh Soni

-

Great peace of mind after having contract with DRI.

Gaurav

-

Appreciate the work ethics and support

KSM Associates

-

"Debt Relief India has been a life saver for me. The constant harassment from recovery agents has completely stopped after joining their settlement plan. Earlier, recovery agents even started calling my relatives, but the team handled that issue too and gave me a proper solution. Their service is exactly the way they explained to me before I took the plan – transparent and genuine. Day by day, my mental pressure is reducing and I finally feel at peace. Truly superb service, highly recommended!"

Jagdish Nandwana

-

Very good services from DRI

Geetanshu Aggarwal

-

Very good service

Amit Agarwal

-

Excellent & Exceptional way of working

Anil Rohit

-

Since the day I have taken the services from DRI I have been advised in each and every situation proactively with prompt responses. The team of DRI are very well versed with the banking law and they're handling all my loans and credit cards related calls very diligently. This is all we want from a client perspective that in this world where people are committing suicides due to loan pressures there is DRI who will take care of all the things and will make your life easy. Thanks DRI & Team for all the efforts and hardwork

Anzal Mansuri

-

I came across Debt Relief India through client reviews that felt genuine and trustworthy, which gave me the confidence to choose their services. Three months into the process, I can say they have commendably handled this difficult stage with steady support and professionalism. The team has been proactive and consistent, significantly reducing creditor calls and visits. They also stepped in effectively whenever recovery agents tried to contact my references, which gave me both relief and confidence in the process. Overall, I am very happy with their service and look forward to completing this journey with them in a confident, peaceful, and legitimate manner.

Sairindhri Moulik

-

Very well

Appdri

-

Commitment! Transparency! Ownership! Rahul and his team has done wonders for me and my wife when it comes to containing harassment from banks and agents. His valuable support and guidance during extreme situations has not only helped me to bounce back, but to gain courage and confidence when I speak with agents now. There was a time when I decided to quit, and even tried other settlement companies as well initially, however, Debt Relief team has given me a second life!

Vinod Walke

-

Advocate Rahul has been a saviour for me and my family. I got the services which was promised to me since Day 1 and within 8 months they helped me close 7 personal loans and 8 credit cards that too at very minimal percentage than what they committed. The best part- They enrolled me to a Zero Fees program and I didn't spend a single penny on my settlement since it concluded within an year. So far I have recommended DRI to multiple people in my organization and few of them are already enrolled with them. Kudos Rahul ji and his team!

Abhishek Rawat

-

Thanks a lot Vinod and Neha for helping me and guiding with the best resolution. The knowledge level of Advocate Vinod ji was beyond my exceptations and he handled the field executives like a Pro! Debt Relief offered me zero fees and with fee option and were extremely transparent with the process and charges. So far I have settled 3 Pls and 5 CCs at an average of 23-25% wherein they committed 40% at start. Their negotiation team is very well informed and they shared multiple call recordings with me to maintain the transparency. God bless this company 🙏

Rishab Sharma

-

Advocate Aditya and Rahul ji are complete powerhouse of knowledge, experience and wisdom. The way they and their team managed my case right from first day, we never expected that honestly. I was misguided by multiple companies and no one was speaking clearly until I connected with Neha on call. The journey is going pretty smooth till now and recovery agents are quite scared of Debt Relief as per my experience. Wishing for the best of the support from team.

Priyanka Sehgal

-

This is an appreciation review for a gentleman named Rahul. I contacted Debt Relief on their helpline number through an Instagram post. Even though my case was not eligible (Home Loan), Rahul guided me on the call about the options that I can avail legally and spent 15 minutes guiding me for an ineligible case. The kind of Human Approach that Rahul showed made be believe about how strong the foundations of Debt Relief are. I am definitely going to refer people to Debt Relief India in case I see anyone suffering. Please send my regards to Rahul, god bless this soul.

Ramneet Chadda

-

I have been using the services of Debt Relief India for 1 month now and I can say from my experience that the efforts that have been put by the team and Mr. Kanishk Dutt have been commendable. I have felt so relieved in this tenure otherwise prior to coming in contact with DRI, I was helpless and was not finding ways to tackle the banks and NBFCs but not only my harassment has been handled by the team but their constant guidance and support have given me a lot of confidence to get out of this situation which I am hoping in coming months I would come out. Thank you for all the help and support and I would look forward further to get your constant guidance.

Kumar Atul

-

It is a good experience with Debt Relief India and the team. Mr. Kanishk Dutt is always there for any of my queries and a very good advisor. I am very much sure that we will settle the loan as quick as possible. Thanks DRI, you are doing a great job.

Kanchan Mala

-

I was really worried due to my debt . And recovery calls and their harrasment. But thanks to the TEAM DRI. who came to my rescue. They managed my all calls from recovery agency and banks. And gave me releif and bought me time so i can focus on my work and manage my things. They also helped me to stop all my home visits by guiding me legally. Kudos to the team DRI and kanishk sir. I will recommend their services. They don't charge any settlement fees which do make them unique settlement agency And the lowest monthly fees. THANKS TO TEAM DRI.

Shivam Raval

-

It was in the month of November when I felt that I would not be able to pay my dues... Just like that, while scrolling on Instagram, I saw an advertisement of Debt Relief India and wanted to contact them... Now I feel that this decision was my best decision... I was so distressed by the harassment calls that I had to use medicine for high blood pressure... Along with the harassment calls, the agents' home visits and office visits were also stopped by Debt Relief India... I am very happy that I got relief from all these calls and visits...From that day till today, every problem of my dues has been solved very well, to the extent that when I message, I also get a fast reply... And soon I will really get relief from debt... Thanks Debt Relief India and special thanks to Kanishk Sir for this support

Piyush Kumar

-

DRI has been very helpful in my loan and CC clearence and fast resolution was given to me very satisfied with their services.

Luv Dhir

-

My personal experience so far has been very good and satisfactory. They have been handling the harrasment calls effectively. More importantly they take care of the home visits by collection agents very well who otherwise would create an embarassing situation. There were times when they have helped me out from visits and calls beyond working hours.

Mohammed Sibgath

-

Debt Relief help me for resolving all my Loan problems “I was drowning in business loans debt and didn’t know where to turn. I found out about the Debt Relief India program which made the process of regaining control over my finances so much easier than I expected. The team is extremely professional and patient with me. They explained every step and gave me the support I needed. Within a few months, I saw a significant reduction in my debt. The relief of not being harassed by creditors is priceless! I highly recommend Debt Relief India their services to anyone struggling with debt.”

Dipesh Patil

-

Professional and nice behaviour of Mr. Kanishk Ji. Keep up the good work 👍

Kharak Singh Khalsa

-

Great service, Enrolling DRI (DEBT RELIEF INDIA) is the best decision of mine.

Yagyansh Soni

-

Great peace of mind after having contract with DRI.

Gaurav

-

Appreciate the work ethics and support

KSM Associates

-

"Debt Relief India has been a life saver for me. The constant harassment from recovery agents has completely stopped after joining their settlement plan. Earlier, recovery agents even started calling my relatives, but the team handled that issue too and gave me a proper solution. Their service is exactly the way they explained to me before I took the plan – transparent and genuine. Day by day, my mental pressure is reducing and I finally feel at peace. Truly superb service, highly recommended!"

Jagdish Nandwana

-

Very good services from DRI

Geetanshu Aggarwal

-

Very good service

Amit Agarwal

-

Excellent & Exceptional way of working

Anil Rohit

-

Since the day I have taken the services from DRI I have been advised in each and every situation proactively with prompt responses. The team of DRI are very well versed with the banking law and they're handling all my loans and credit cards related calls very diligently. This is all we want from a client perspective that in this world where people are committing suicides due to loan pressures there is DRI who will take care of all the things and will make your life easy. Thanks DRI & Team for all the efforts and hardwork

Anzal Mansuri

-

I came across Debt Relief India through client reviews that felt genuine and trustworthy, which gave me the confidence to choose their services. Three months into the process, I can say they have commendably handled this difficult stage with steady support and professionalism. The team has been proactive and consistent, significantly reducing creditor calls and visits. They also stepped in effectively whenever recovery agents tried to contact my references, which gave me both relief and confidence in the process. Overall, I am very happy with their service and look forward to completing this journey with them in a confident, peaceful, and legitimate manner.

Sairindhri Moulik

-

Very well

Appdri

-

Commitment! Transparency! Ownership! Rahul and his team has done wonders for me and my wife when it comes to containing harassment from banks and agents. His valuable support and guidance during extreme situations has not only helped me to bounce back, but to gain courage and confidence when I speak with agents now. There was a time when I decided to quit, and even tried other settlement companies as well initially, however, Debt Relief team has given me a second life!

Vinod Walke

-

Advocate Rahul has been a saviour for me and my family. I got the services which was promised to me since Day 1 and within 8 months they helped me close 7 personal loans and 8 credit cards that too at very minimal percentage than what they committed. The best part- They enrolled me to a Zero Fees program and I didn't spend a single penny on my settlement since it concluded within an year. So far I have recommended DRI to multiple people in my organization and few of them are already enrolled with them. Kudos Rahul ji and his team!

Abhishek Rawat

-

Thanks a lot Vinod and Neha for helping me and guiding with the best resolution. The knowledge level of Advocate Vinod ji was beyond my exceptations and he handled the field executives like a Pro! Debt Relief offered me zero fees and with fee option and were extremely transparent with the process and charges. So far I have settled 3 Pls and 5 CCs at an average of 23-25% wherein they committed 40% at start. Their negotiation team is very well informed and they shared multiple call recordings with me to maintain the transparency. God bless this company 🙏

Rishab Sharma

-

Advocate Aditya and Rahul ji are complete powerhouse of knowledge, experience and wisdom. The way they and their team managed my case right from first day, we never expected that honestly. I was misguided by multiple companies and no one was speaking clearly until I connected with Neha on call. The journey is going pretty smooth till now and recovery agents are quite scared of Debt Relief as per my experience. Wishing for the best of the support from team.

Priyanka Sehgal

-

This is an appreciation review for a gentleman named Rahul. I contacted Debt Relief on their helpline number through an Instagram post. Even though my case was not eligible (Home Loan), Rahul guided me on the call about the options that I can avail legally and spent 15 minutes guiding me for an ineligible case. The kind of Human Approach that Rahul showed made be believe about how strong the foundations of Debt Relief are. I am definitely going to refer people to Debt Relief India in case I see anyone suffering. Please send my regards to Rahul, god bless this soul.

Ramneet Chadda

get your estimate

Why Do We Need To Calculate Your Relief?

We use this data securely and only to calculate your potential settlement.

01How is Debt Relief India the best for you?

We are one of the most trusted and transparent debt settlement companies in India, putting your peace of mind first. We ensure the highest debt waivers, helping you become debt-free faster, so you can live with dignity, respect, and without stress.

02Is there a fixed percentage at which you promise to settle all my debts?

The success of negotiations depends on many factors, including the lender’s policies and your cooperation. What we can assure you is that our experienced team will work hard to get you the best possible settlement. Your commitment to make fixed & regular deposits into your account and staying patient during the process is key. Debt settlement is a teamwork effort, and together, we aim for the best results.

03Will my interest be frozen during the debt relief program?

During a debt relief or settlement program, interest on your debts typically continues unless your creditor agrees to freeze it. However, as part of the negotiation process, debt relief companies like Debt Relief India will work to secure the best possible settlement for you. This settlement amount often includes the accumulated interest and fees, potentially resulting in a significantly reduced total debt. It’s important to note that while the interest may not be frozen, the final settlement can still offer much savings compared to the original debt amount.

04How does Debt Relief India support its customers even after the settlement?

Even though getting the NOC is not directly our responsibility, we still chase and follow up with banks/NBFCs to issue NOC/NDC after the loans or cards are settled. We also help clients to escalate matters to the PNO of the bank, RBI Ombudsman, Cyber Crime Portal, and Consumer Forums.

05Will my credit score be affected?

Yes, debt resolution can impact your credit score short-term, but once debts are settled, your score gradually improves with good credit habits and financial discipline.